|

|

|

||||

|

Welcome to the GoFuckYourself.com - Adult Webmaster Forum forums. You are currently viewing our boards as a guest which gives you limited access to view most discussions and access our other features. By joining our free community you will have access to post topics, communicate privately with other members (PM), respond to polls, upload content and access many other special features. Registration is fast, simple and absolutely free so please, join our community today! If you have any problems with the registration process or your account login, please contact us. |

|

|

|||||||

| Discuss what's fucking going on, and which programs are best and worst. One-time "program" announcements from "established" webmasters are allowed. |

|

|

Thread Tools |

|

|

#1 | |

|

Confirmed User

Industry Role:

Join Date: Jan 2004

Location: oddfuturewolfgangkillthemall!!!!!!!

Posts: 5,656

|

Who prints money and who owes who?

I thought the Federal Reserve printed money and we owed interest on every dollar but this explanation confused me.. is this guy correct?

Quote:

|

|

|

|

|

|

|

#2 |

|

So Fucking Banned

Industry Role:

Join Date: Jun 2011

Location: the land of woke sleuths

Posts: 16,493

|

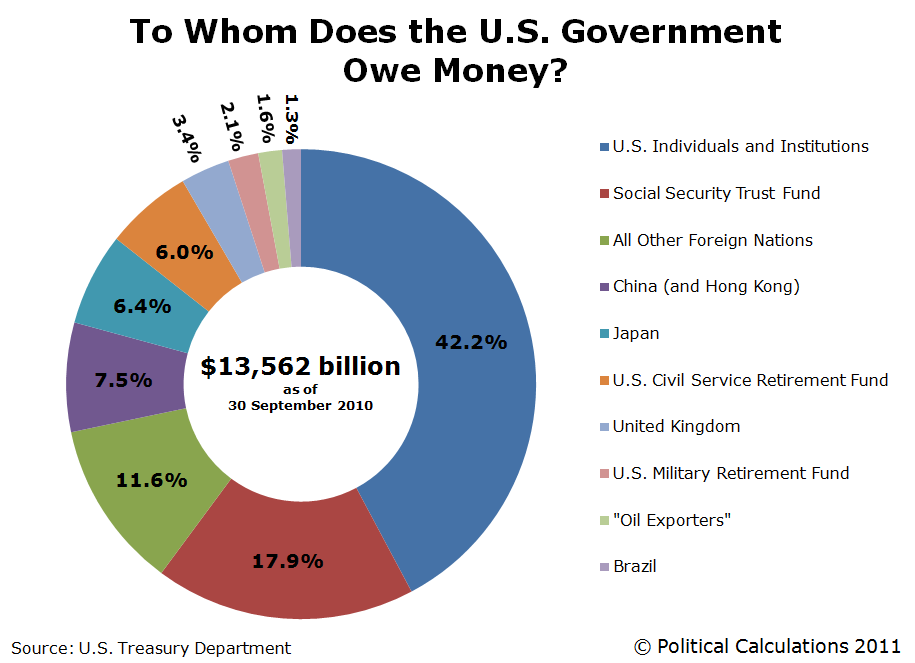

he is correct untill proven incorrect in a court of law. The chinese own our debt, we will either go to war with them or be owned by them in the not to long future.

|

|

|

|

|

|

#3 |

|

Confirmed User

Industry Role:

Join Date: Mar 2003

Location: Seattle, WA

Posts: 1,771

|

This is from over a year ago. Unfortunately we have racked up another 1 trillion + more debt since then. China owns about 8% of the US debt.

__________________

|

|

|

|

|

|

#4 |

|

Too old to care

Industry Role:

Join Date: Jun 2001

Location: On the sofa, watching TV or doing my jigsaws.

Posts: 52,943

|

It's thought the Greeks might vote in a Government that will call Germany's bluff and go for a straight gift of money. That's the only way to look at it as they have zero chance of ever paying back the escalating debt. Yet the EU still hangs onto the flawed model of the Euro.

It appears Greek hospitals are running out of drugs and basic things like gauze, holiday makers are worried about going there as they fear a collapse. Not sure if this is scare mongering but it seems Greece can't afford itself, is living way above it's means and some Greeks want Germany and a few others to support them. The big question is WHY? What does or will ever offer to warrant support? Olives, beaches, ????. The only reason they were in the Euro was political, the only reason they stay in the Euro is political. Yes when they get out they will default on the loans or devalue the Drachma to a level that repaying it will be worthless and then who will be next? It's no longer a question of if, it's only when. Slinging them out of the Euro and maybe the EU, so the Spanish, Portuguese, Italians and even the UK Labour party can see what happens when mounting debts aren't repaid. Yes the UK Labour Party is saying the UK should start borrowing more in the hope they can stay immune from the coming EU recession. Can the US afford to borrow more? Can the US afford to cut taxes? My view says no. Because they're both going to mean more debt and that means postponing the inevitable. |

|

|

|